on the stock market

Jul 19

July 19th, 2017

this post is incomplete

After spending 18 years of my life idolizing rich investment bankers on Wall Street, I have come to a brutal realization:

-

A lot of investing is gambling??

-

I realized this after reading Nassim Taleb’s book, Fooled by Randomness. To summarize, Taleb proves that behaviours like hindsight bias and pattern-seeking are widely prevalent in today’s society, especially in the investment banking sector. Often, bankers are victim to completely random occurrences in the market, yet attribute them to “skill” and “foresight”. I wrote a bit about this:

- An example of this behaviour is the justification for the start of World War 1. As was drilled into me in high school, the assassination of Franz Ferdinand and the escalating tension and militarization in various countries predicted this international conflict. The ensuing World War seems to have been inevitable - after the events have transpired. This is an example of hindsight bias. As Niall Ferguson, a professor of history at Harvard, makes clear in his paper The international bond market between the 1848 revolution and the outbreak of the First World War, war bond prices were steady. The world had not noticed these so-called significant events. If these hints towards the upcoming conflict were as clear as we now make them out to be, why did the price of war bonds not rise? Was there a sudden, universal lack of desire to make profit? or were the events we speak of today not obvious at all. Clearly, the latter is more in line with human nature. We feel the need to justify events after the fact in order to reassure ourselves that we will see it coming next time.

-

matthew counts as more evidence for this point

-

-

You can never win against a computer.

- It take a human about 300-400 milliseconds to blink. Currently, it takes High Frequency Trading Firms (basically computers that trade stocks) 85 nanoseconds to execute a trade. So if you think that you are gonna be the fastest one to buy a stock when it goes down, you’re not. To put that into perspective, in the time it take you to blink your eye, one HFT computer could execute 3.5 million trades. Basically, computers are just alot faster that you are.

-

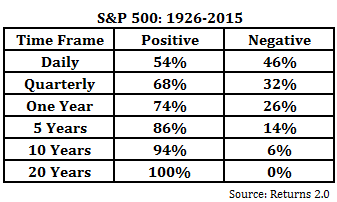

Unpredictable in the short term, predictable in the long term: The only certain way to make money in the stock market is over time.

^if you invest in an S&P 500 index, you can basically flip a coin to see whether you will make money tommorow. In a decade though, you have a much higher chance of profit.

This is a excerpt from Naked Statistics

The S&P 500 is a nice example of what an index can and should do. The index is made up of the share prices of the 500 leading U.S. companies, each weighted by its market value (so that bigger companies have more weight in the index than smaller companies). The index is a simple and accurate gauge of what is happening to the share prices of the largest American companies at any given time.